Key Takeaways

- GSK acquires rights to a prostate cancer ADC from Syndivia for up to £268 million.

- The ADC uses Syndivia’s GeminiMab technology.

- Shows strong anti-tumour activity and good safety in preclinical tests.

- GSK calls it “best in class potential”.

- Fits GSK’s pipeline of targeted cancer therapies.

GSK has announced that it has agreed to acquire exclusive rights to an ADC from the biotech firm Syndivia for metastatic castration resistant prostate cancer (mCRPC). Under the terms of the agreement, GSK will own exclusive rights to develop and commercialise the therapy. Syndivia will receive an upfront sum for the rights, along with development and commercial milestone payments totalling up to £268 million.

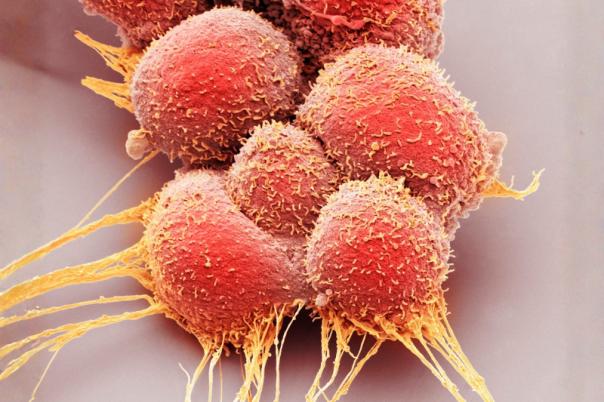

‘Urgently needed’

Each year, around 1.4 million men are diagnosed with prostate cancer globally, with 10-20% developing mCRPC within five years. Targeted treatments for the disease are limited, standard care can be hard to access or tolerate, and patient outcomes are modest. Median survival is about two years, and the five-year survival rate is roughly 30%.

Hashem Abdullah, GSK’s Global Head of Oncology, R&D, said: “Prostate cancer represents a significant health burden and an emerging area of growth for GSK, where targeted therapies are urgently needed in metastatic castration-resistant settings.”

GeminiMab conjugation technology

The asset was designed using Syndivia’s GeminiMab conjugation technology. The company has used this proprietary platform to create a suite of anti-cancer ADCs with enhanced therapeutic profiles.

Sasha Koniev, Chief Executive Officer, Syndivia, said: “We are proud that GSK will advance this programme on a global scale. This agreement underscores the value of our GeminiMab ADC platform and the opportunity to bring a promising new therapy to patients with pressing unmet medical needs.”

‘Best in class potential.’

The asset so far has demonstrated enhanced anti-tumour activity, shrinking tumours in preclinical models. Furthermore, its safety profile has been promising, not causing a proportional increase in significant side effects at higher doses. In a press statement, GSK said that the ADC had ‘best in class potential.’

Pipeline trends

The acquisition of this candidate fits in with current trends in GSK’s pipeline which now includes a range of ADCs including GSK’227 for pulmonary neuroendocrine carcinoma (NEC).

Abdullah commented: “The addition of this ADC builds on GSK's growing portfolio and strengths in tumour-targeted technologies, including GSK’227, our B7-H3-targeting ADC.”