Introduction

The political climate in North America and Europe is characterised by economic uncertainty and regulatory shifts, which continue to challenge the biopharma landscape in these regions. Therefore, innovation is no longer an ideology but a necessity for this industry. Yet, these obstacles present a unique window of opportunity for international investors, venture capitalists, and strategic partners to expand their biotech portfolios. Now is the time to flip the script and reframe global biotech investment options.

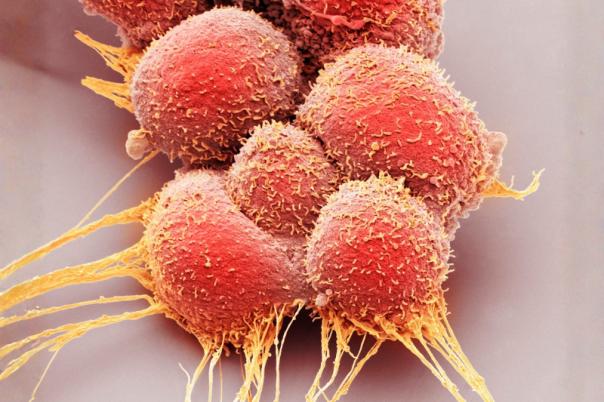

In this climate, a growing demand for targeted therapies has caused the global biologics market to boom. Biologics are a diverse group of medicines derived from living organisms used to treat conditions such as arthritis, cancer, and inflammatory diseases. Compared to small molecules, biologics target certain biological processes with higher precision and greater efficacy and therefore have advantages in targeted therapy. The biologics market is gaining traction across the globe. The Asia-Pacific (APAC) biologics development market was valued at $4.5 billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 13.3% during the forecast period between 2024 and 2030.

Despite the excitement surrounding biologics, they come with their own sets of challenges. Biologics are highly sensitive to a given manufacturing process and starting materials compared to small molecules, which retain their chemical identity regardless of synthetic method and material used.

Furthermore, biologics’ complex and heterogeneous structures make them difficult to characterise, meaning clinical effects are unpredictable in patients. Finally, large molecules are expensive, therefore, patients in low and middle-income countries may not be able to afford them. Nevertheless, the APAC region has made crucial strides in the biologics field, seeking to tackle these challenges and promote wider patient accessibility.

India’s Biologics Landscape

India’s biologics and biosimilars sector is soaring. For instance, over 95 biosimilars have received regulatory approvals in India, one of the highest globally. Strategic settlements, a string of regulatory approvals, and international partnerships have pushed Indian biotech to the forefront of global markets.

Biocon is India’s largest biopharmaceutical company. The company’s biologics subsidiary is committed to enabling affordable access to high-quality biosimilars for millions of patients worldwide.

The Company received the industry’s first approval of an interchangeable biosimilar for insulin glargine in the U.S. It is also the first globally to receive approvals for biosimilar trastuzumab, biosimilar pegfilgrastim, and interchangeable biosimilar aflibercept from the U.S. Food and Drug Administration (FDA). Other Indian biotechs such as Dr Reddy’s Laboratories and Lupin have received clearance to launch next-generation therapies in the US, further validating India’s global reputation.

The Indian government is also backing its country’s biopharma initiatives by offering policy and infrastructure support. The National BioPharma Mission is supported by the Department of Biotechnology and the Biotechnology Industry Research Assistance Council (BIRAC). These organisations offer funding and regulatory pathways in sync with global standards, including the US FDA. This contributes to faster global market access.

From a regulatory standpoint, India’s Central Drugs Standard Control Organization released an updated biosimilar that aligns closely with the WHO biosimilar standard. While clinical trial sample sizes in India are usually small (minimum 100 patients in test groups), which accelerates development timelines, international scepticism around data robustness remains a barrier on some occasions.

China’s Large Molecule Market

China is heavily investing in next-generation technologies such as bispecific antibodies and antibody-drug conjugates (ADCs), which positions it as an innovation leader. The first biosimilar to gain approval in China was a rituximab biosimilar (HLX01;2019) developed by Shanghai Henlius Biotech in 2019. Since then, China has gone from strength to strength. Between 2019 and 2020, China saw a further 11 biosimilar approvals. As of 2025, there are over 100 biosimilars in clinical development and over 40 projected to enter the market in the next couple of years.

The approval pathway in China for biosimilars differs from that of the EMA and FDA. China’s National Medical Products Association requires biosimilars to be submitted through the same pathway as innovative biologics but with an adjusted set of data requirements. As a result, compared with other countries that provide a condensed pathway for biosimilars, approval in China may take longer than North American and European counterparts. However high regulatory scrutiny and data quality is ensured.

President Xi Jinping has centred China’s policy-making around health. The Chinese Government’s Healthy China 2030 Initiative outlines a long-term strategic plan to put health at the forefront of the country’s agenda. This demonstrates the state’s commitment to becoming a global biotech powerhouse.

Conclusion

Policy changes and a lack of funding in North America and Europe are forcing the biotech industry to rethink its notions around biotech partnerships and find new ways to adapt to these changes. Countries like India and China are capitalising on their resources and scientific talent to fill the innovation gap. China is well-positioned as an innovation leader, and India shines for affordability, capacity, and export readiness.

2025 marks a critical inflection point. It's a moment when economic necessity aligns with scientific opportunity in the APAC region. For global investors, biotech entrepreneurs, and strategic collaborators seeking stability and innovation should keep in mind the APAC’s thriving biologics space.